The insurance industry faces increasing complex challenges. The nature of risk has changed significantly over the past decade, due to emerging sustainability risks that carry big economic, environmental and societal consequences. Accounting for these risks is critical for enterprise risk managers and insurers to be successful.

According to UN Environment Programme (UNEP) Executive Director and Under-Secretary-General Achim Steiner, the insurance industry serves as an important early warning system for society by amplifying risk signals. However, CERES, a leading investor advocacy group, concluded in a 2013 report that “climate regulatory uncertainty is creating new risks and the potential for corporate liability claims that exceed the loss levels on which contracts were based.” Policy framework lags behind many sustainability risks due to the difficulty in regulating ubiquitous greenhouse gas sources that contribute to climate change: car exhaust, energy use in buildings, agricultural livestock, deforestation, and methane from crowded landfills.

The insurance industry has moved the needle, ever so slightly, within the last five years. In 2009, the UNEP Finance Initiative Insurance Working Group recognized “the fundamental role of the insurance industry in sustainable development is not a choice, but the only option.” Insurers are communicating strong risk signals stemming from a wide range of sustainability risks, which include environmental, social, and governance (ESG) risks. However, while underwriters judge ESG risks to have significant loss potential, UNEP FI found societal response lagging behind the underwriters’ assessment of the risk involved.

In 2012, regulators in three large and influential states – California, Washington, and New York – began requiring insurers writing more than $300M in premiums in their states to submit responses disclosing their climate-related risks to the Insurer Climate Risk Disclosure Survey. In 2013, the survey expanded to Connecticut and Minnesota, and the reporting threshold was lowered to $100M in premiums, consequently doubling the number of respondents.

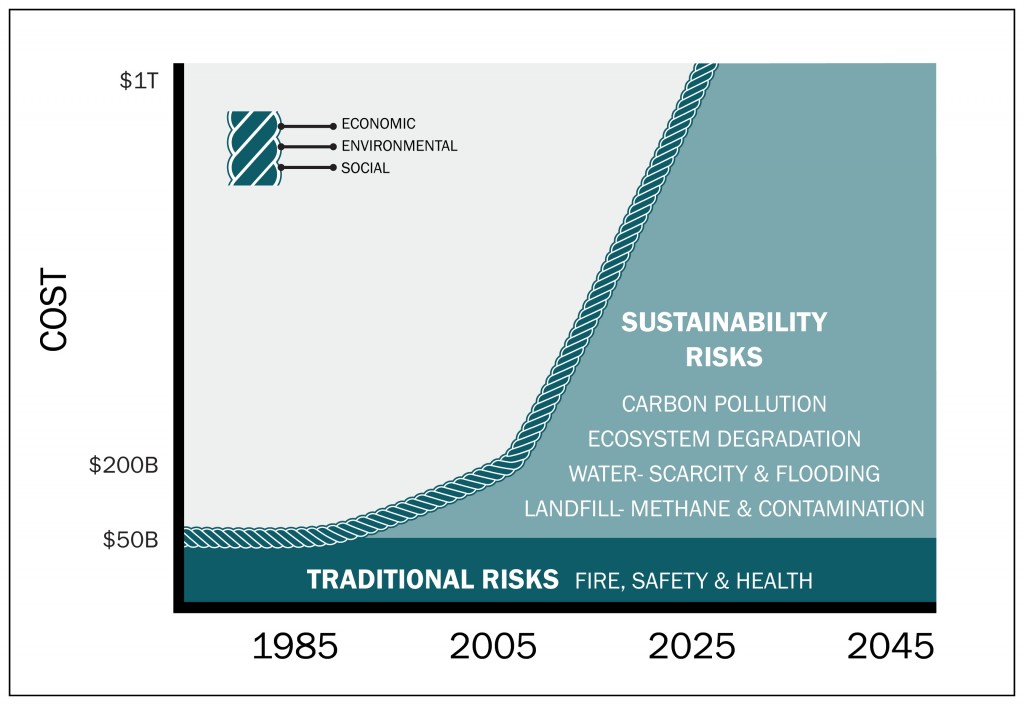

In 2013, the Carbon Disclosure Project reported 80% of the world’s largest companies had climate change strategies. In contrast, just over 12% of insurance companies responding to the Insurer Climate Risk Disclosure Survey had comprehensive climate change strategies. Although the insurance industry is beginning to respond to sustainability risks, it’s clearly time to pick up the pace. Economic losses from extreme weather events have risen from an annual global average of about $50 billion in the 1980s to close to $200 billion over the last decade, according to the World Bank. A 2014 UN report found the costs of mitigating key sources of climate risk will be trillions of dollars in coming years. This cost is on top of the spend on economic losses.

Insurers think and work in the long-term and manage complex interrelationships. As both financial and non-financial risks of prospective insureds are assessed, sustainability risks typically fall into the latter category, because costs are hidden on traditional ledgers. For manufacturing and commercial sectors, they are often related to climate adaptation, carbon pollution, water, energy and materials recovery project execution. Sustainability risks require looking beyond compliance with laws, to assessing continuity and resilience planning.

Benchmarking studies of companies considered sustainability champions reveal a broader definition of risk beyond the traditional fire/safety/health scope to include any event or practice that could disrupt the company from achieving business objectives. Examples include regulatory non-compliance and lost profits due to waste in production that does not convert to value for customers. This broader definition of risk, inclusive of sustainability, will lead to a long list of factors and potential impacts. From a practical perspective, it is important to create a focus on priority risks that are both material and significant by way of three criteria: economic, environmental, and social impacts.

A sustainability assessment is conducted to create management strategies that seize the highest priority opportunities. The assessment should become part of the enterprise risk management process, and identify risks and opportunities from the following categories:

- Management Systems. This assessment should not only provide a look at the company’s goals, standards, certifications and reporting structure, but also the executive team’s commitment to, and employee engagement with, sustainable business practices.

- Measurement. Here, the assessment should begin with investigating the company’s environmental metrics and how they are tracked and benchmarked. In addition, performance indicators that incorporate cost and revenue implications are key to understanding hidden costs and developing risk mitigation strategies.

- External Influences. Assess how the company utilizes engagement strategies and communication protocols with key external stakeholders, including suppliers and customers. Also, understand the organization’s engagement level in partnerships that pool resources to overcome barriers to sustainable best practice.

- Materiality. The assessment needs to address the life cycle stages of products and packaging to identify the significant points of impact. Plus, the company’s supply chain greenhouse gas emission impacts and business practices, as well as the company’s customer sustainability business requirements must be considered.

It is imperative to deliver insurance products that take into account the positive and negative effects of the insured’s business operation. A Harvard Business School research team compared 180 companies – 90 high sustainability firms, 90 low sustainability firms – and found that over an 18-year period, the high sustainability firms outperformed the low in both stock market and accounting metrics. Identifying and securing companies with sustainable business practices is key to spreading risk over a larger pool. There is an opportunity to attract these lower risk companies into your pool through premium incentives. A past example of this is when insurers offered lower liability premiums for manufacturers with an ISO 14001 environmental management system (EMS) in place.

As many different industries express concern about sustainability risks, the insurance industry faces uncertainty in positioning itself to prosper. These risks impact the insurance industry more profoundly, because miscalculation creates opportunity for huge losses that clearly damage the insurance carriers themselves, but most importantly, make business as usual impossible for their customers. Low risk is no longer solely defined by traditional means, it is now strongly influenced by sustainability components that need to be properly assessed to reduce the potential for great loss.

About the Author

Susan Graff is a Principal and Vice President at Resource Recycling Systems (RRS). An environmental expert and sustainability practitioner with over 25 years of industry and US EPA experience, Susan develops enterprise level strategies and solutions for corporate sustainability clients. Prior to joining RRS, Susan founded ERS Global, a sustainability consultancy that provided assessment, strategy, performance measurement and reporting services for the Fortune 200. At EPA, Susan was responsible for national environmental risk assessment policy and regional materials and waste management programs. She holds an M.S. degree in Technology and Science Policy from Georgia Institute of Technology, and a B.S. in Biology from Western Illinois University.